Special discounts and incentives

Overview

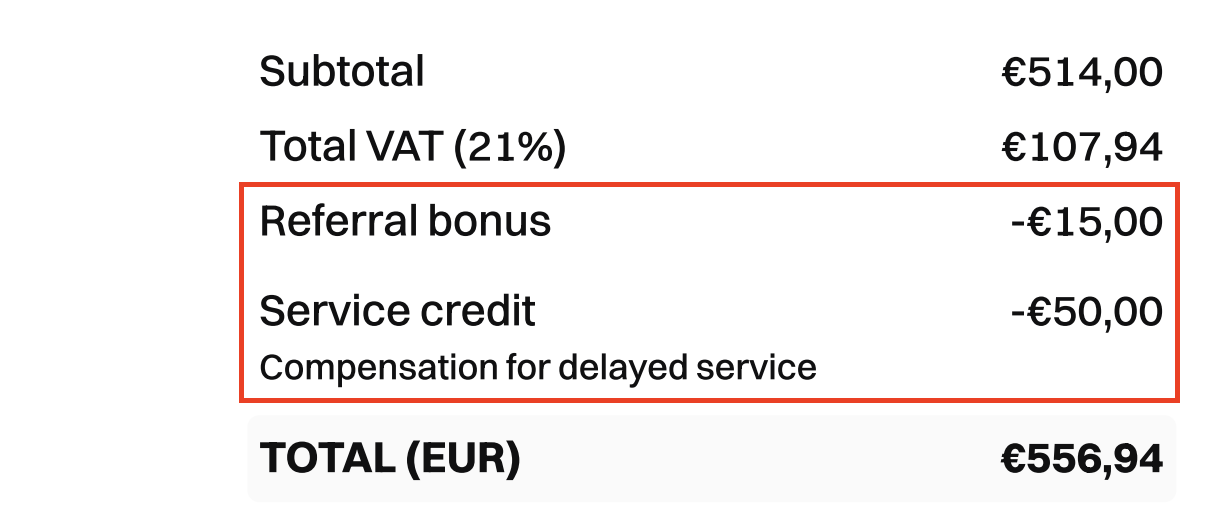

Special deductions refer to exclusive cost savings on particular products and services. Unlike regular discounts, these deductions do not reduce the taxable base on sales invoices, that is, they are applied after VAT calculations. Examples of special deductions include incentives and rebates.

Monite supports up to 10 deductions per invoice or quote.

Deductions vs discounts

Deductions are similar to discounts, the difference being how the subtotal and total are calculated.

-

Discounts are applied to the subtotal before VAT. In other words, discounts affect the taxable base and, as a result, the amount of VAT being charged.

-

Deductions are applied to the total amount after VAT. Deductions do not affect the taxable base and VAT amounts. You can think of deductions as post-tax discounts.

Add deductions

You can define deductions when creating and updating invoices and quotes.

Use the deductions array to specify a list of deductions to apply.

For each deduction, you can define the deduction amount, the label to use in PDFs, and an optional memo with additional information.

The memo is displayed below the deduction line in PDFs.