Accepting SEPA Credit payments

Available in: 🇪🇺 EU, 🇬🇧 UK

Supported currencies: EUR, GBP

Supported payer countries: Austria BETA, Belgium, Germany, Ireland, Italy, Netherlands, UK

Overview

SEPA Credit Transfer (SCT) is a payment method used for cross-border and domestic Euro payments within the Single Euro Payments Area (SEPA) region. Both the sender and the recipient can be companies or individuals.

Use cases

SEPA Credit is one of the payment methods available for Monite payment links. Entities can use payment links to both send and receive SEPA Credit payments.

Receive invoice payments from counterparts

- Entity uses the partner’s application to issue an invoice to a counterpart (client).

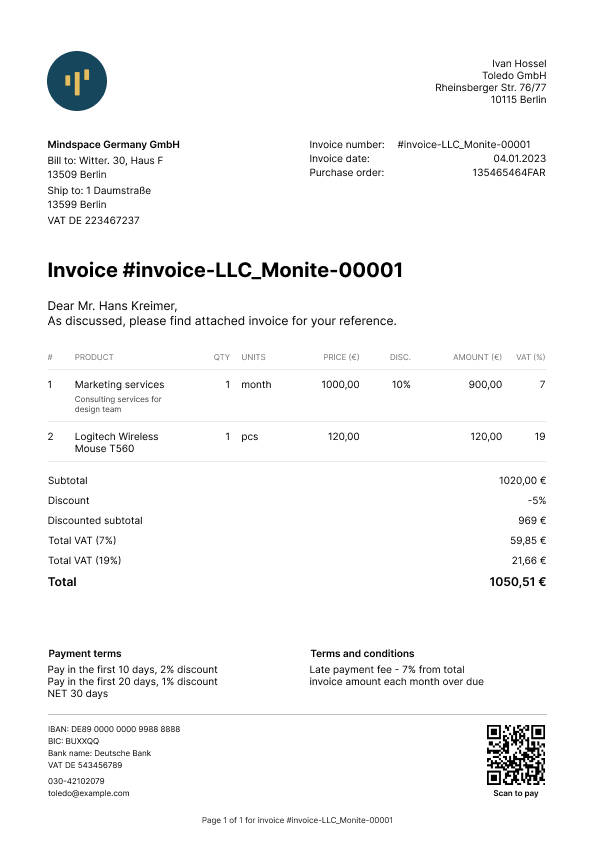

- The application generates a payment link for this invoice. This payment link is automatically included in the invoice PDF and invoice email message sent to the counterpart. Entities can also share payment links with counterparts in any other way they prefer.

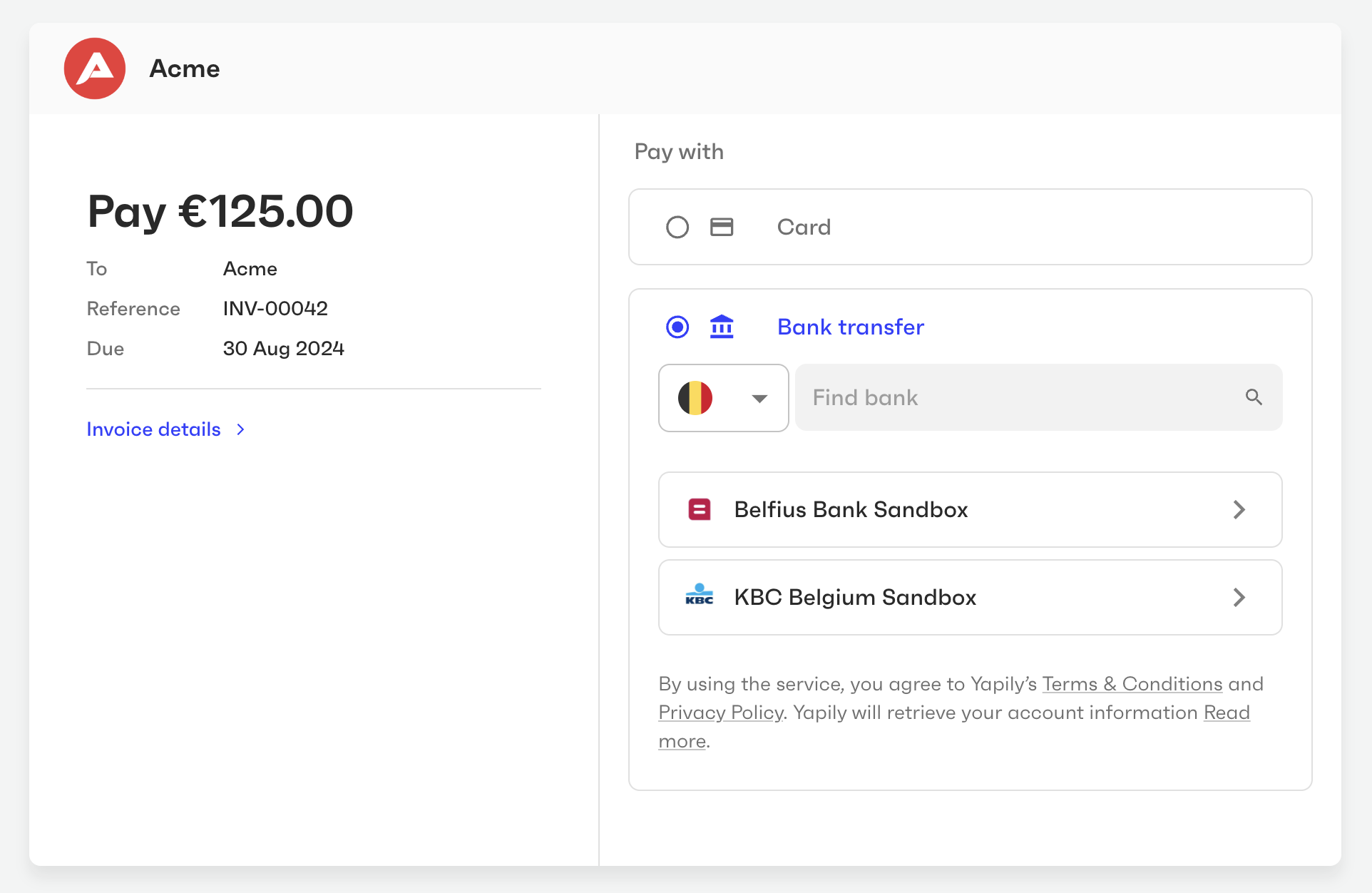

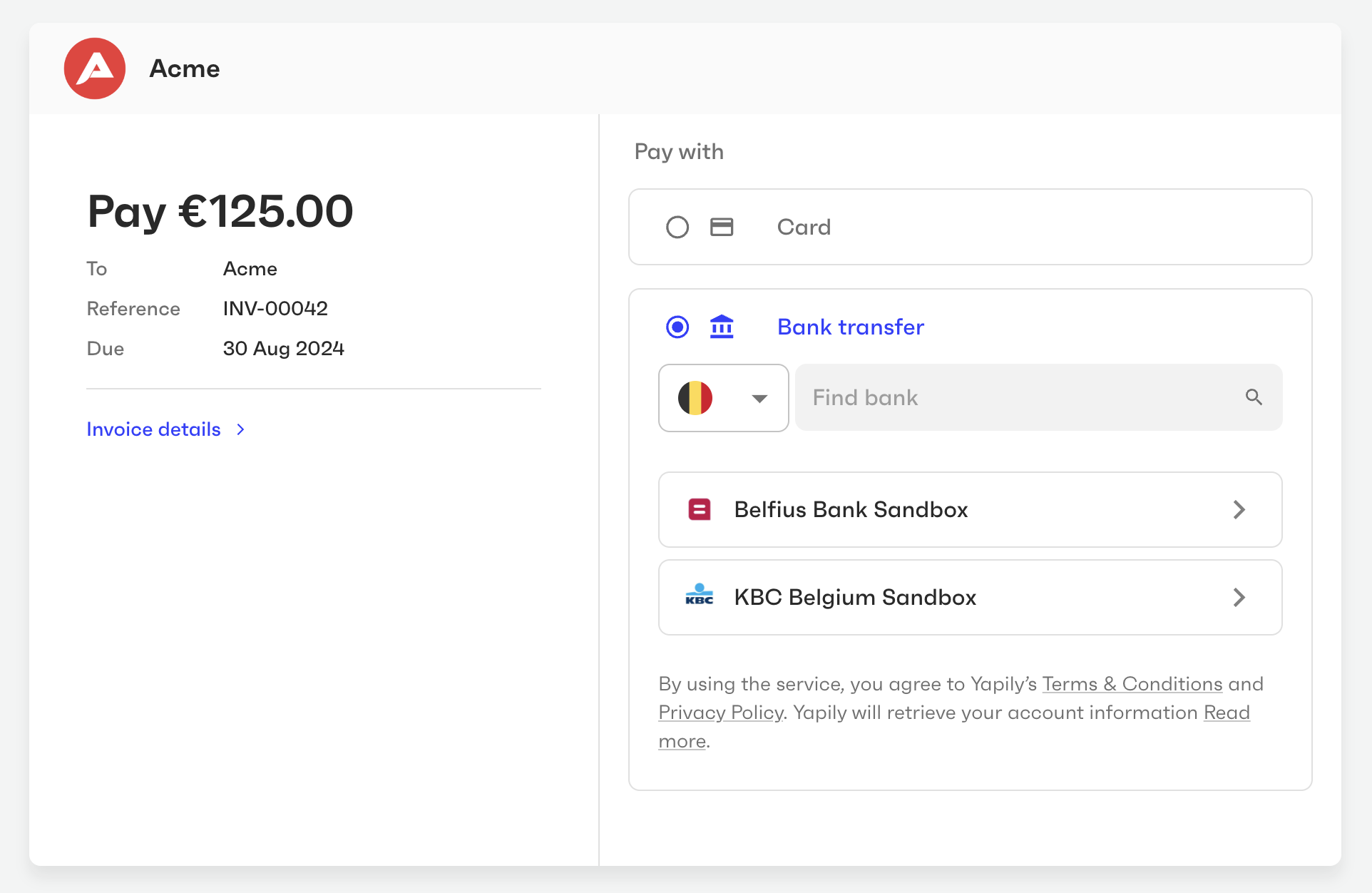

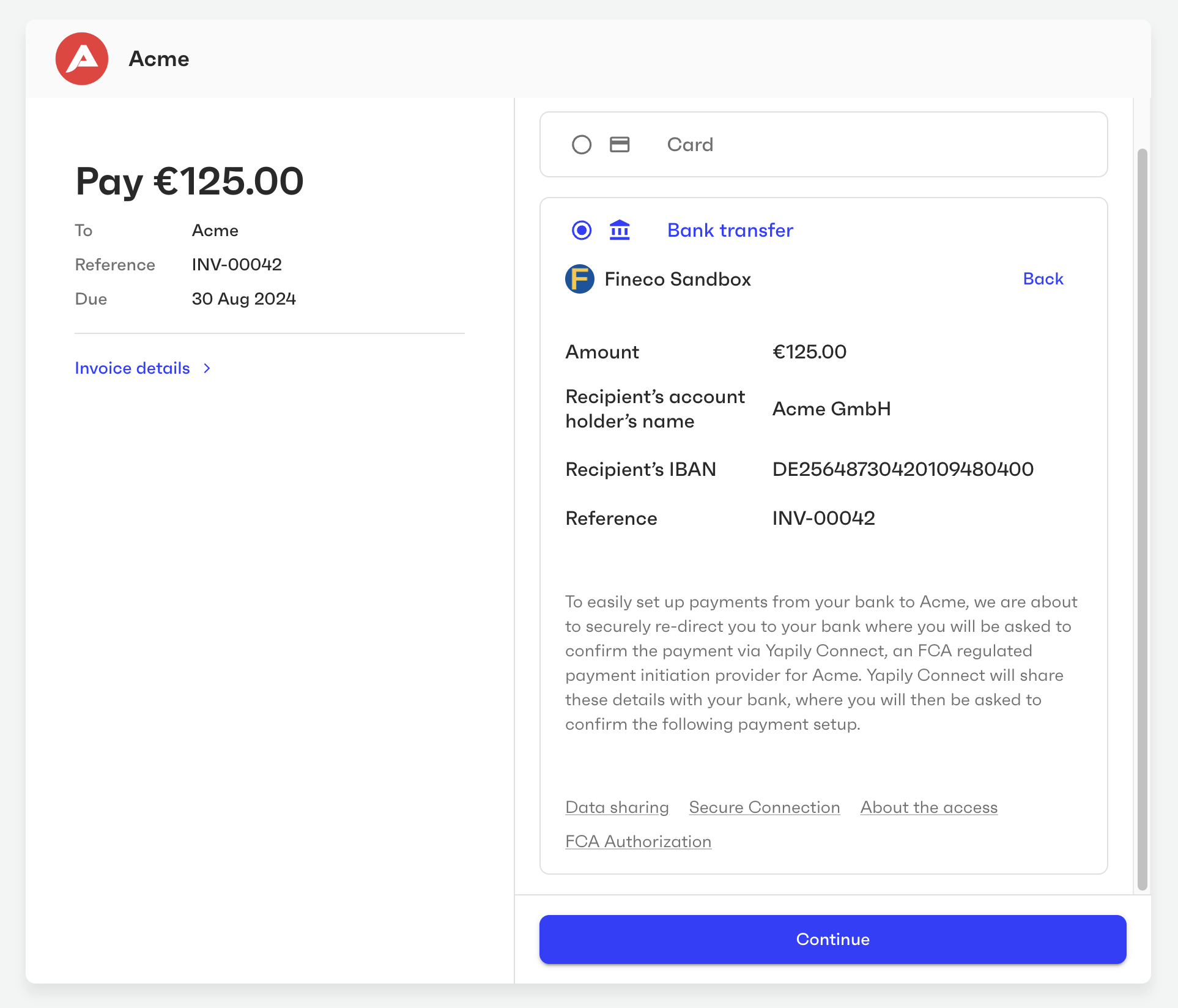

- Counterpart navigates to the payment link. The payment page displays the payment amount, invoice details, and the entity bank account details.

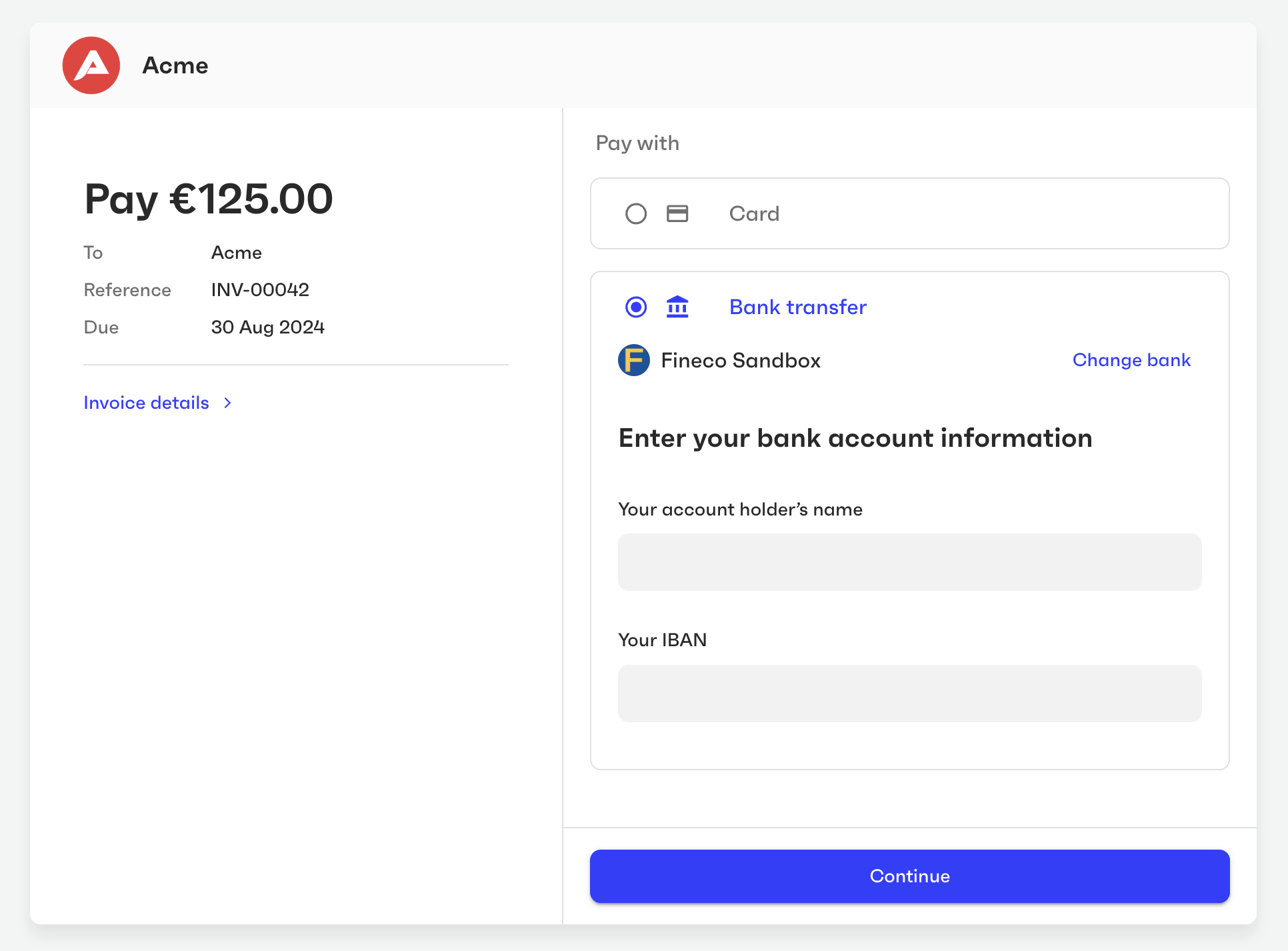

- To pay via SEPA Credit, the counterpart selects “Bank transfer” as the payment method and provides consent to withdraw the payment amount from their bank account.

- Monite initiates the payment with the counterpart’s bank.

- After the payment request is accepted by the counterpart’s bank, the funds are transferred via SEPA Credit to the entity bank account specified in the invoice.

Requirements

From an integration perspective, using SEPA Credit requires the following from Monite partners:

- Server side - to generate payment links, receive webhooks about the payment status, and (optionally) customize the look and feel of the payment page.

- Client side - you can use either Monite-hosted payment page (optionally masked with your own domain), or an embeddable Payment component.

Additionally:

- Both the sender (counterpart) and the recipient (entity) must be based in the EU or UK.

- If the recipient entity is based in the EU:

- Payment currency must be EUR. For example, in case of invoice payment scenarios, the invoice currency must be EUR.

- The entity’s default bank account must be in a country in the SEPA zone. See Entity bank accounts to learn how to specify bank account details.

- If the recipient entity is based in the UK:

- Payment currency must be GBP. For example, in case of invoice payment scenarios, the invoice currency must be GBP.

- Entity bank account must have the account holder name specified.

SEPA Credit does not require any additional entity onboarding besides the abovementioned requirements. However, if an entity also needs other payment methods, those payment methods may require additional onboarding. For more information about the onboarding process, see Payments onboarding.

Scenario: Accept a SEPA Credit payment

This guide assumes an entity and its bank account have already been created.

1. Enable the SEPA Credit payment method for the entity

To check if SEPA Credit is already enabled for the entity, call GET /entities/{entity_id}/payment_methods. If sepa_credit is not present in the list of payment methods, call PUT /entities/{entity_id}/payment_methods to add it. For more information, see Enabling payment methods for an entity.

The example below assumes that card is a pre-existing payment method enabled for the entity, and we’re enabling the entity to both receive and send SEPA Credit payments.

2. Create a payment link

A payment link is a URL that leads to a secure payment page where the payer (in this example, a counterpart) can specify their payment details and initiate the payment.

To generate a payment link, call POST /payment_links. In the request body, specify the recipient of the payment (in this example, an entity), the payment_methods to be displayed on the payment page, and other details. The required request fields vary based on whether or not the invoice being paid is stored in Monite. For more information, see Create a payment link.

Payment link for an Accounts Receivable invoice

Payment link for an external invoice

A successful response returns a payment_page_url that can be shared with the payer.

A payment intent for tracking the payment is also automatically created and stored in the payment_intent field of the payment link. You can also access that payment intent directly by calling GET /payment_intents/{payment_intent_id}.

3. Share the payment link with the payer

After a payment link has been generated, the entity can share its URL (payment_page_url) with the payer (counterpart) using any way they prefer, for example, via email, via a website link or button, inside an app, or through other channels.

If the payment link was generated for an Accounts Receivable invoice created via Monite, the PDF invoice will include a QR code pointing to the payment link, and the invoice email notification will also include the payment link.

When the payer navigates to the payment link, they will see the payment page displaying information about the invoice and payment amount. The payer can select their preferred payment method and enter their payment information to initialize the payment.

4. Track the payment status

After the payer confirms the payment, the payment link status is changed to succeeded and the payment intent status is changed to processing. Monite triggers the following webhooks when the status of payment links and intents is changed:

payment_link.status_updatedpayment_intent.status_updated

You can monitor the status of the payment intent to know when the payment has been settled or rejected. The ID of the payment intent is stored in the payment_intent_id field of the payment link and is also included in payment_intent.status_updated webhooks. For more information, see Track the payment intent.

Remarks

- The payment reference value is normalized when passed to the payment processing provider.

Test SEPA Credit payments

See Testing payments for a list of test credentials that you can use with the sandbox version of the payment page to simulate user consent and test both successful and declined payments.